Silly Money

My Complete Guide to S-Corporations

The S-Corp deadline is creeping up on March 15, and I keep getting the same question over and over again, "Should I elect S-Corp status for my business?"

So let me be real with you: This is one of the most misunderstood topics in all of tax strategy.

Most people think an S-Corp is some completely separate type of business entity. Like you file some papers with the Secretary of State and suddenly you have an S-Corp. And that's not how it works at all.

An S-Corp is simply a tax election you can make with your existing LLC.

You file a single form with the IRS (Form 2553) and your LLC gets taxed differently while remaining the exact same legal entity.

And for a lot of self-employed business owners, this single form can save tens of thousands of dollars every single year.

But here's the thing: it's not for everyone!

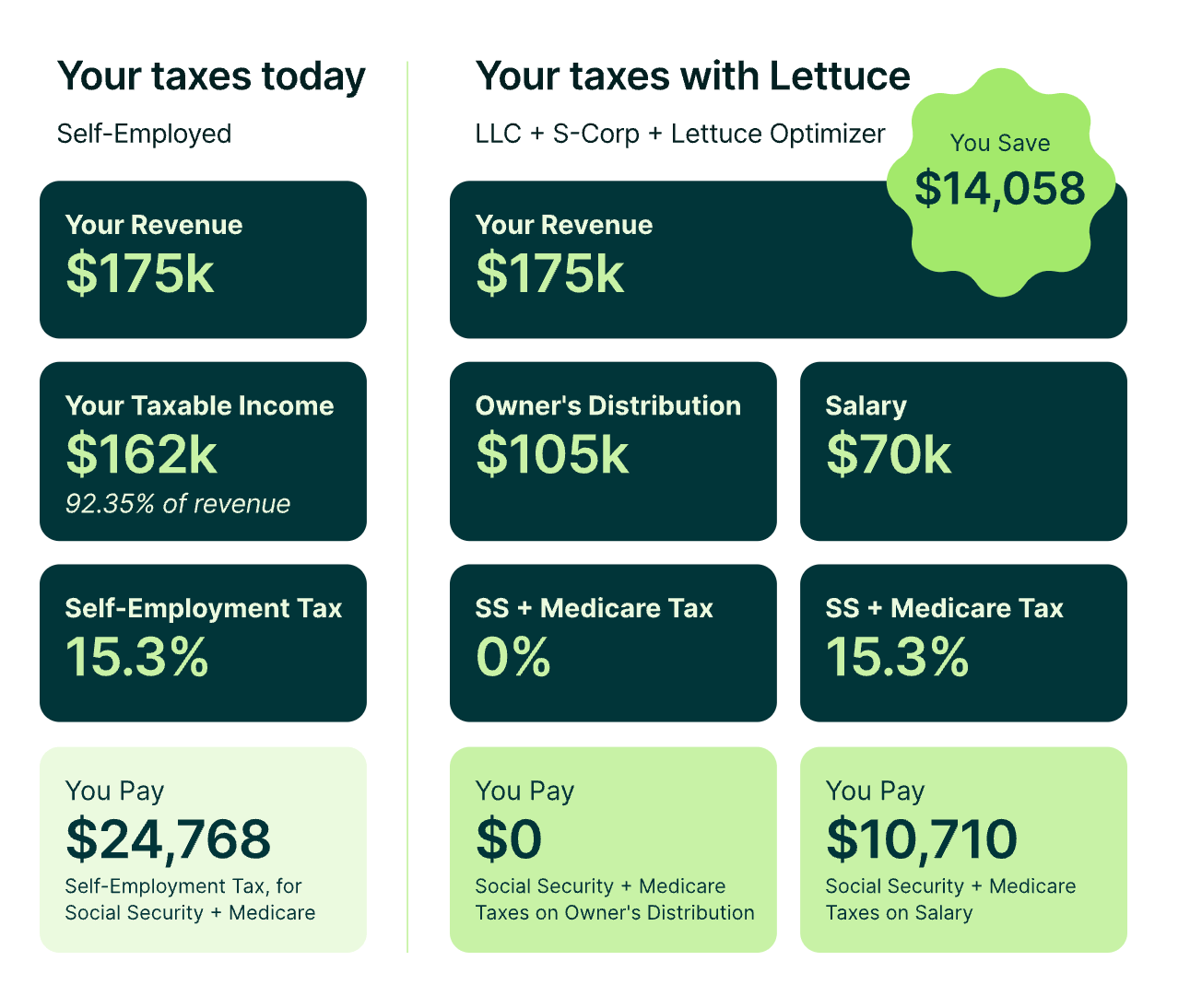

Don’t let the complexity of S-Corps stop you from saving $10K+ on taxes.

Lettuce was built for the business owners who went independent to focus on their craft, not become accountants.

They handle everything from S-Corp setup, payroll, quarterly taxes, and bookkeeping starting at just $299/mo!

What Actually Is An S-Corp?

I want to clear up the biggest misconception right away.

When people hear "S-Corp", they think it's a business structure like an LLC or a C-Corp. Something you file with your state.

That’s wrong!

An S-Corp is purely a federal tax election for LLCs.

It allows business profits to pass through directly to your personal tax return, avoiding the double taxation that C-Corps face.

Your business stays exactly the same at the state level.

Here's the simplest way to think about it:

LLC (default) → All profits flow to your personal tax return and are subject to self-employment tax

LLC (S-Corp election) → You split your income between salary (subject to payroll taxes) and distributions (not subject to payroll taxes)

And that split right there is where the magic happens…

How S-Corps Actually Save You Money

As a sole proprietor or single-member LLC, you pay self-employment tax on all your business profits.

This is 15.3% of the first $176,100 of income (the 2026 Social Security wage base), and 2.9% above that. Brutal!

Let's say you make $200,000 in net business income this year.

Without an S-Corp:

Self-employment tax: approximately $25,000+

With an S-Corp (paying yourself a $100,000 salary):

Payroll taxes on salary: approximately $15,300

Payroll taxes on remaining $100,000 in distributions: $0

Total savings: approximately $10,000+

The savings get even more dramatic as your income increases:

Net Business Income | Estimated Annual S-Corp Savings |

$100,000 | ~$4,000 |

$200,000 | ~$12,000 |

$300,000 | ~$25,000 |

$500,000+ | ~$30,000+ |

It’s important to note that these numbers vary based on your specific W-2 salary, state taxes, and other deductions.

But the point still stands that savings can be substantial!

Who Is a Good Fit for an S-Corp?

Here's my rule of thumb: start seriously considering an S-Corp once you hit $100,000+ in net business income.

Below that threshold, the administrative costs and hassle often outweigh the tax savings.

You're looking at payroll fees, a separate tax return (Form 1120-S), and additional complexity in your financial life.

But once you're consistently above $100K in profit, the math starts to make a lot of sense.

You're a particularly good candidate if:

You have consistent, predictable business income

You're comfortable running payroll (or paying someone to do it)

You don't plan to raise venture capital (S-Corps can't have VC investors)

You're in a state that treats S-Corps favorably

The sweet spot is often somewhere between $100K and $500K in net business income. That's where the savings-to-hassle ratio is most favorable.

Who Should NOT Elect S-Corp Status?

An S-Corp is not a universal solution, and there are several situations where it can actually hurt you.

If you fit under any of these categories, an S-Corp probably doesn’t make sense:

Foreign citizens and non-resident aliens cannot be S-Corp shareholders. If you're not a US citizen or green card holder, an S-Corp is off the table.

Certain jurisdictions penalize S-Corps! Tennessee taxes S-Corp earnings at 6%, which can completely wipe out your federal savings. New York City has a separate tax on S-Corps. California charges an $800 minimum franchise tax plus a 1.5% tax on net income. Before electing S-Corp status, you absolutely need to understand how your specific state treats S-Corps.

If you plan to raise venture capital, an S-Corp becomes problematic. VCs typically invest through funds, which can't hold S-Corp shares. You'd need to convert to a C-Corp anyway, which is a painful and potentially expensive process.

If your income is highly variable or below $100K, the administrative burden probably isn't worth it. You're paying for payroll services and a more complex tax return to save a few thousand dollars at most.

If you want to pursue QSBS benefits, an S-Corp is incompatible. The most powerful tax break in America requires your company to be a C-Corp. You can't get QSBS treatment with an S-Corp election.

The Critical Deadline

Missing the S-Corp deadline can cost you an entire year of tax savings.

So, here's what you need to know:

For existing businesses: You must file Form 2553 by March 15, 2026 to be treated as an S-Corp during this tax year. A pro tip: if you're planning ahead, you can file Form 2553 any time during the prior year for favorable tax treatment. For example, if you want S-Corp status for 2027, you could file the form any time during 2026.

For new businesses: You have 75 days (2 months and 15 days) from your formation date to file for S-Corp status for your first tax year.

If you miss the deadline, your S-Corp election typically won't be effective until the following year (which means losing out on potentially tens of thousands in tax savings!)

There is a late election relief process if you can demonstrate "reasonable cause" for missing the deadline, but don't count on it. The IRS doesn't have to approve your request.

How to Set Your Salary (Most People Mess This Up!)

The IRS requires S-Corp shareholders who work in the business to pay themselves a "reasonable salary."

This is where a lot of people get into trouble.

You CANNOT pay yourself a $1 salary and take the rest as distributions.

The IRS will reclassify your distributions as wages, assess back payroll taxes, add penalties and interest, and potentially audit you.

To determine reasonable compensation, the IRS looks at factors like:

Your training and experience

The duties and responsibilities of your role

What comparable businesses pay for similar positions

The time and effort you put into the business

The company's size and gross receipts

A common rule of thumb is that your salary should be somewhere between 30% and 50% of your net business income. But this is highly situation-dependent.

The tricky part of this calculation is that you want your salary to be high enough to pass IRS scrutiny, but not so high that you're losing the tax benefits of the S-Corp structure.

This is one area where working with a qualified tax professional really pays for itself. They can help you find the optimal salary that maximizes your savings while keeping you compliant.

S-Corps and Retirement Contributions

One of the common follow up questions I get related to S-Corp is how the tax election affects retirement contributions.

The answer is it changes things significantly.

With a regular LLC or sole proprietorship, your Solo 401k contribution is based on your total net self-employment income. You can contribute roughly 20% of your net earnings as an employer contribution (after subtracting half your self-employment tax).

With an S-Corp, your employer contributions are based on your W-2 salary only. You can contribute up to 25% of your W-2 wages as an employer contribution.

Let's compare assuming $200k in net business income as we did earlier.

As an LLC:

Employee contribution: $24,500 (2026 limit)

Employer contribution: roughly 20% of ($200K minus half SE tax) ≈ ~$37,000

Total potential contribution: ~$61,500

As an S-Corp with $100K salary:

Employee contribution: $24,500 (2026 limit)

Employer contribution: 25% of $100K = $25,000

Total potential contribution: ~$49,500

But wait, that's less with the S-Corp!

This is why the salary calculation matters so much. You need to balance your self-employment tax savings against your ability to maximize retirement contributions.

For 2026, the total Solo 401k contribution limit is $72,000 (or $80,000 with catch-up contributions for ages 50-59 and 64+, and up to $83,250 for ages 60-63 with the super catch-up).

To fully max out employer contributions with an S-Corp, you'd need a W-2 salary of at least $186,000.

A good tax professional can model out the optimal salary that balances payroll tax savings with retirement contribution capacity.

This is exactly the kind of nuance that makes the "should I elect S-Corp?" question so complex.

The Qualified Business Income Deduction

The Qualified Business Income (QBI) deduction allows eligible pass-through business owners to deduct up to 20% of their qualified business income. Thanks to the One Big, Beautiful Bill signed in 2025, this deduction is now permanent.

Here's where it gets interesting for S-Corp owners: your QBI calculation can be affected by the wages you pay yourself.

For high earners above the income threshold (approximately $406,000 for joint filers in 2026), the QBI deduction gets limited. One of the limitations is based on W-2 wages paid by the business.

If your taxable income is in the phase-out range ($406,000 to $544,600 for joint filers), your S-Corp salary can actually help you qualify for more of the QBI deduction.

A smart tax professional can help you find the salary number that:

Minimizes self-employment taxes

Maximizes your QBI deduction

Optimizes retirement contribution capacity

It's a three-dimensional optimization problem, which is why I keep emphasizing the value of professional help here.

S-Corps and the PTET Loophole

If you're a high earner in a state with significant state income taxes, there's another reason to consider S-Corp status: the Pass-Through Entity Tax (PTET).

The 2017 tax law capped your SALT (state and local tax) deduction at $10,000. For high earners in states like California and New York, this was devastating.

But if you have a pass-through entity like an S-Corp or partnership, you can elect to pay your state taxes through the business. This makes the state taxes a deductible business expense, bypassing the $10,000 SALT cap entirely.

For someone making $500K+ in a high-tax state, the PTET election can save $30,000 or more in federal taxes annually.

The catch is that sole proprietors don't qualify. So, you need to be structured as an S-Corp or partnership.

This is yet another reason why the S-Corp election might make sense even if the self-employment tax savings alone are marginal.

The PTET rules and deadlines vary dramatically by state. California's deadline for 2026 is June 15, while New York's is March 15 (same as the S-Corp election deadline). Work with someone who knows your specific state's rules.

The True Administrative Costs

Let me be honest about the additional work an S-Corp creates:

You must run payroll. This means setting up a payroll system (Gusto, QuickBooks Payroll, etc), paying yourself on a regular schedule, withholding federal and state taxes, and filing quarterly payroll returns.

You need a separate tax return. Form 1120-S is the S-Corp tax return, due March 15 (with extensions available). This is in addition to your personal return. Most people hire a CPA to prepare this, adding to your costs.

You’ll receive a Schedule K-1. The S-Corp issues you a K-1 showing your share of income, which you then report on your personal return.

Estimated quarterly taxes still apply. Even with payroll withholding, you may need to make estimated payments for any income not covered by withholding.

For most people, the administrative costs run somewhere between $1,500 and $5,000 per year when using traditional payroll services plus additional CPA fees. Platforms like Lettuce bundle payroll, taxes, and bookkeeping together, which can bring costs down significantly. Make sure your tax savings exceed these costs before electing.

The Common Mistakes to Avoid

In the last four years working with business owners on tax strategy, I've seen the same S-Corp mistakes over and over:

Paying yourself too little. This is the number one mistake. People get greedy with the tax savings, pay themselves a $30K salary on a $300K business, and end up in hot water with the IRS. Pay a reasonable salary and document your rationale.

Missing payroll deadlines. Payroll tax penalties are no joke. Set up automatic payroll processing so you never miss a deadline.

Not running payroll at all. I've seen people elect S-Corp status and then just take draws like they did before. This defeats the entire purpose and creates a compliance nightmare.

Electing in the wrong state. Some states are S-Corp hostile. Do your homework before filing.

Forgetting about PTET elections. In many states, you need to make a separate election for PTET, often with a different deadline. Don't leave money on the table.

Not adjusting salary as income changes. If your business grows significantly, your reasonable salary should too. Revisit this annually with a tax pro.

How to Actually Make the Election

If you've decided an S-Corp makes sense, here's what you need to do:

File Form 2553 with the IRS before the deadline (March 15 for existing businesses, or within 75 days of formation for new ones). This is where you officially elect S-Corp status. If you miss the deadline, some providers (like Lettuce) can help with late election relief filings.

Get all shareholders to consent. Every shareholder must sign the form agreeing to the election.

Set up payroll. You can start taking a salary once the election is filed. Most providers (Gusto, QuickBooks, Lettuce, etc.) make this easy.

Track distributions separately. Your accountant will need clear records of salary payments versus shareholder distributions.

Prepare for your 1120-S filing. This is due March 15 of the following year (for calendar year filers).

Form 2553 is surprisingly simple. The IRS doesn't charge a fee to file it. You can even submit it yourself if you're comfortable, though I'd recommend having a tax professional review it.

The Bottom Line

Should you elect S-Corp status?

Here's my honest assessment:

If you're making $100K+ in consistent net business income and you're in a state that treats S-Corps favorably, it's almost certainly worth serious consideration.

The potential savings of $5,000 to $30,000+ annually add up fast.

But this isn't a decision to make in isolation.

The S-Corp election interacts with:

Your retirement contribution strategy

Your state tax situation

The PTET workaround eligibility

Your QBI deduction

Your long-term business plans (VC, QSBS, etc.)

I know I've said it multiple times in this article, but it bears repeating, work with a qualified tax professional to evaluate your specific situation. The right team can model out multiple scenarios and help you understand the true after-tax impact of the election. Or you can get started by calculating your estimated tax savings for free.

The March 15 deadline is coming up fast. Missing the deadline means waiting another year and potentially leaving tens of thousands of dollars on the table. So if you've been putting this decision off, now is the time to act.

Questions about S-Corps? Reply and let me know.

— Ankur

Author Disclosure: I'm writing this as myself, not as some investment adviser or broker-dealer. I’m not a tax professional, this is all purely educational or my personal thoughts - not investment, legal, tax, or professional advice. Financial decisions involve risk, including losing money. Taxes are complex. Please do your own research or talk to a licensed pro before acting on anything you read here