Silly Money

The Ultimate Guide to the Solo 401k: The Most Powerful Retirement Account in America

The single biggest personal finance win for anyone with self-employment income:

Setting up a Solo 401k

This is the most powerful retirement account in America if you know how to use it to its full potential.

It allows you to:

Contribute up to $70,000 per year, per spouse

Take the entire amount as a tax deduction, or funnel it into your Roth IRA or a combination thereof

Invest the dollars in virtually any asset with no taxes while it compounds

Borrow up to $50,000 from your Solo 401k if you ever need short-term liquidity

Get a tax credit for setting one up

This article explores the nuance behind these accounts, including:

Let’s dive in.

Who is eligible for a Solo 401k?

Most people are eligible to set up a Solo 401k if they have any self-employment income.

This could be a full-fledged business with no external employees or something as simple as earning a few dollars a year for posting on social media.

Here are the official criteria for Solo 401k eligibility:

Self-Employment or Business Owner Income

This can be income you make as a solo business owner — or if you have a full-time W-2 job, any money you make on the side. Rental income, or income from capital gains do not count, but typically most other types of income will make you eligible.

You do NOT need a “business” to qualify for a Solo 401k. You can make money under your SSN and still qualify. However, you need to have NET income for the year.

No Full-Time Employees

You cannot have any full-time employees excluding your spouse or any other co-owners of the business. You can have any number of 1099 employees or contractors without affecting your eligibility.

Even though it’s called a “Solo 401k”, you technically do not have to be a solo business owner!

You can have multiple owners of a business, all of whom are allowed to set up their own Solo 401k. Any spouses that work on the business can also set up their own Solo 401k.

With that said, here are some important edge cases to consider:

What if you own multiple businesses?

If you fully own multiple businesses, you typically cannot have full-time W-2 employees at ANY business to be eligible for a Solo 401k.

All businesses with the same ownership are considered a “controlled group” and typically need at least 20% or more of the ownership to not overlap to remain eligible.

If there are multiple permutations of owners, it gets a little trickier to calculate controlled group thresholds. I recommend reading this article on controlled group rules or checking with a tax professional.

What if you have part-time employees?

You can have any number of 1099 contractors and not affect your eligibility. However, if you have part-time W-2 employees, it gets a little more nuanced.

You can still have a Solo 401k with part-time W-2 employees as long as you fulfill both of these criteria:

No part-time W-2 employee works more than 1,000 hours a year

No part time W-2 employee has worked more than 500 hours a year for 3 consecutive years

As always, this article is written for informative purposes only, and if your case gets complicated, it’s always recommended to double check with a tax professional!

The incredible benefits of a Solo 401k

There are many reasons why I consider the Solo 401k the most powerful retirement account in America.

If I were to summarize the top reasons, they would be:

Size

Flexibility

Optimization

Let’s break down each one.

Size

A Solo 401k allows each participant to contribute up to $70,000 a year.

If you are over 50, you get an additional $7,500 a year. If you are between 60-63, you get an additional $11,250 a year.

For two spouses working in the same business, that is close to an annual contribution of $150,000 a year… this is completely unmatched in terms of the “size” of benefit of any major retirement plan!

A corporate 401k on paper has the same maximum size, but it’s practically impossible to hit since the employer match is almost never meaningful enough.

A SEP IRA on paper has the same maximum size, but you do not have employee or optional after-tax contributions so it’s harder to completely max it out. I share more later on why you typically prefer a Solo 401k over a SEP IRA.

If a $70,000 contribution per spouse was not enough, a Solo 401k also pairs really well with a Cash Balance Plan that can get your annual pre-tax contribution up to the low 6-figures.

Flexibility

A Solo 401k also shines over most other account types by being substantially more flexible. You can typically set it up in a way that optimizes for your specific financial goals.

Some of the big flexibility benefits for me are:

Support for pre-tax and Roth contributions

Everyone has different financial goals, and the fact that a Solo 401k allows you to make the entire contribution as pre-tax or Roth (via the mega backdoor Roth loophole) is super powerful. Personally, I take full advantage by mixing and matching both contribution types.

Invest in (almost) any asset

While corporate 401k plans are super limited in investment options, a Solo 401k allows the plan owner to invest in (almost) any asset they like.

This gives you full flexibility to pick individual stocks or ETF’s, or invest in alternative assets if you like the asset class. You can also optimize for investments with low to no fees, unlike a corporate plan where you don’t have the choice.

Borrow up to $50,000 at any time, for any reason

A big fear when locking up dollars in a retirement account is losing access to that money for decades.

A Solo 401k allows participants to borrow up to 50% of their account value (to a maximum of $50K) at any time, for any reason. While you have to pay a market interest rate, it goes back inside your account!

Optimization

Having access to a Solo 401k goes a very long way in fully optimizing your personal financial life.

There are two very big things a Solo 401k unlocks that can get very tricky without having access to this specific type of account:

A Backdoor Roth IRA becomes tricky without a Solo 401k

If you want to do a Backdoor Roth IRA every year, you ideally want to have no other dollars in any pre-tax or SEP IRA. The easiest way of doing this is transferring it to your pre-tax Solo 401k.

Without this account type, you have to transfer it into your work 401k plan, where you end up losing a lot of flexibility and typically have additional fees.

You now have “Mega Backdoor Roth” access

If you pick a Solo 401k provider that gives you access to “mega backdoor Roth”, a Solo 401k lets you unlock this benefit, even if your employer plan does not support this. You are limited to using this only for self-employment income, but this is a massive benefit for high earners.

If these big three benefits — size, flexibility and optimization were not enough, the cherry on top is you also get a $500 tax credit for 3 years (or $1500 total) for setting up a Solo 401k via the Eligible Automatic Contributions Arrangements (EACA) tax credit.

All you need is a Solo 401k plan document that supports automatic contributions, and a tax pro to file for this, and you can get paid for setting one up!

How much you can contribute to a Solo 401k

While the overall limit for 2025 is up to $70,000 per year (unless you are over 50), your specific contribution limits vary based on a few different criteria:

The contribution type (employee vs employer vs optional after-tax)

The way your business is set up or incorporated today

How much you may have already contributed to other retirement plans

Your Overall Limit

Your overall limit is your net self-employment income to a global maximum of $70,000 unless you are over the age of 50.

Sole Proprietor or Single Member LLC: This is your net income from self-employment minus one-half self-employment taxes.

S-Corp or C-Corp: This is the total W-2 wage you are getting paid by the business.

When you change your business type (i.e. if you elect to file taxes as an S-Corp), be careful on how this affects your overall contribution limits!

Contribution Types

There are typically three types of contributions you can make and the limits are different for each of them:

Employee contributions

Employee contributions are limited at $23,500 per year. These can be pre-tax or Roth contributions.

If you are over the age of 50, you get an additional $7,500 here — and if you are 60-63, you get an additional $11,250.

Employer contributions

Employer contributions are only limited by your overall limit.

If you are a sole proprietor or single-member LLC, you can contribute up to 20% of your net self-employment income minus one-half self employment taxes.

If you are an S-Corp or C-Corp, the limits are up to 25% of your W-2 salary.

Optional after-tax contributions

Your optional after-tax limits are only limited by the overall limit as described above! These contributions are used for the Mega Backdoor Roth IRA strategy.

This can be a great away to get almost the entirety of your self-employment income into a Solo 401k. But remember: you do not receive a tax deduction here!

The easiest way of plugging all of this in would be to use the Solo 401k contribution calculator on the Carry blog.

How Much You Have Contributed to Other Retirement Plans

Contributions to other retirement plans also affect your limits as follows:

Shared employee contributions

Your employee contribution limit of $23,500 is shared across all retirement plans you contribute to. So if you max that out, you cannot double down and also contribute to it under your Solo 401k.

Typically, separate overall, employer and optional after-tax limits

Usually, your overall and employer limits are completely separate for your Solo 401k. This means you can max out multiple 401k plans at once!

The one important exception to know is a 403b retirement plan. A 403b retirement plan is considered to be a “controlled group” with your Solo 401k so the plan also shares employer contribution limits!

Solo 401k contribution deadlines

I’m going to share the specific deadlines to set up and contribute to a Solo 401k here.

But for simplicity, I typically recommend to do these two things by December 31:

Set up your Solo 401k plan

Make a contribution “election” aka a written record of how much you intend to contribute under each bucket

As long as you do these two things by the end of the year, you have until you file your taxes to actually fund the account.

While making an election, it makes sense to overshoot what you think you will contribute.

There is NO penalty for contributing less than what you elect (as long as you file the right number with your taxes), but you are not supposed to contribute more than what you elect.

Now, let’s imagine you did not do this by December 31 - what are the specific deadlines we are working with?

This gets quite complicated and varies by how long the Solo 401k plan has been around, the business type and the contribution type.

I’ll make a table to illustrate the deadlines:

Business Type | Plan Setup | Employer | Employee (no election) | Employee (with election) | Optional After-Tax |

|---|---|---|---|---|---|

LLC or Sole Prop (first year having a Solo401k) | Tax filing due date, without extensions | Tax filing due date, with extensions | Tax filing due date, without extensions | N/A | Tax filing due date, with extensions |

LLC or Sole Prop (second year or later having a Solo 401k) | Tax filing due date, with extensions | Tax filing due date, with extensions | December 31 | Tax filing due date, with extensions | Tax filing due date, with extensions |

S-Corp | Tax filing due date, with extensions | Tax filing due date, with extensions | December 31* | Tax filing due date, with extensions* | Tax filing due date, with extensions |

C-Corp | Tax filing due date, with extensions | Tax filing due date, with extensions | December 31* | Tax filing due date, with extensions* | Tax filing due date, with extensions |

*subject to your payroll company’s W-2 or corrected W-2 deadlines

Complicated, no?

For simplicity, try and have the plan setup and election done by December 31 so you can chill!

Why a Solo 401k beats a SEP IRA

One of the most frequent questions I get asked is to compare a Solo 401k against a SEP IRA.

Historically, not many providers supported a Solo 401k so accountants and advisors tended to recommend SEP IRAs.

However, in almost every case a Solo 401k is a superior choice over a SEP IRA:

Can typically contribute more dollars to a Solo 401k

Since a Solo 401k supports employee and employer contributions, you can typically contribute much more to a Solo 401k. At $100K in net self-employment income, your Solo 401k limits are almost twice as much as SEP IRA limits!

A Solo 401k also supports “catch-up contributions” for people over the age of 50 which allows you to get more dollars in than a SEP IRA.

Support for Roth contributions and Mega Backdoor Roth

While a SEP IRA can technically support Roth contributions, the IRS has not delivered specific guidelines on how to implement it. As a result, no SEP IRA providers support Roth contributions.

The Mega Backdoor Roth is one of the most powerful parts of a Solo 401k and no similar feature exists with a SEP IRA.

Can borrow money from your Solo 401k

You can borrow up to 50% of your account value to a maximum of $50,000 from your Solo 401k for any reason. No such feature exists with a SEP IRA.

Leaves the Backdoor Roth IRA loophole open

A Solo 401k is a vital tool in allowing someone to execute a backdoor Roth IRA without being subject to the pro rata rule.

Ideally, you would want zero dollars in any pre-tax IRA (including a SEP IRA), which is typically accomplished by transferring all dollars to a Solo 401k

Pairs more effectively with a Cash Balance plan

For advanced business owners making mid 6-figures, a cash balance plan offers an even bigger tax benefit. A cash balance plan pairs very well with a Solo 401k, but doesn’t work very well with a SEP IRA.

You may be wondering... is there ever an occasion where we would prefer a SEP IRA over a Solo 401k?

It’s rare, but could happen in these specific scenarios:

If you have multiple employees and want to make a matching contribution for ALL of them. You would not be allowed to set up a Solo 401k in this case, but can still do a SEP IRA.

If you have multiple recent employees, and want to contribute only for yourself, you could set up a SEP IRA that only kicks in after 1 or 2 years of employment. After 3 years, everyone becomes eligible however.

A Solo 401k does have an extra tax form requirement for accounts with a balance over $250,000 (Form 5500-EZ) but typically your custodian would help with that.

Where to setup a Solo 401k

Most providers have now woken up to the power of a Solo 401k and let you open an account.

However, where you decide to open a Solo 401k depends quite a bit on what features are important to you.

Here’s how I would think about the different providers:

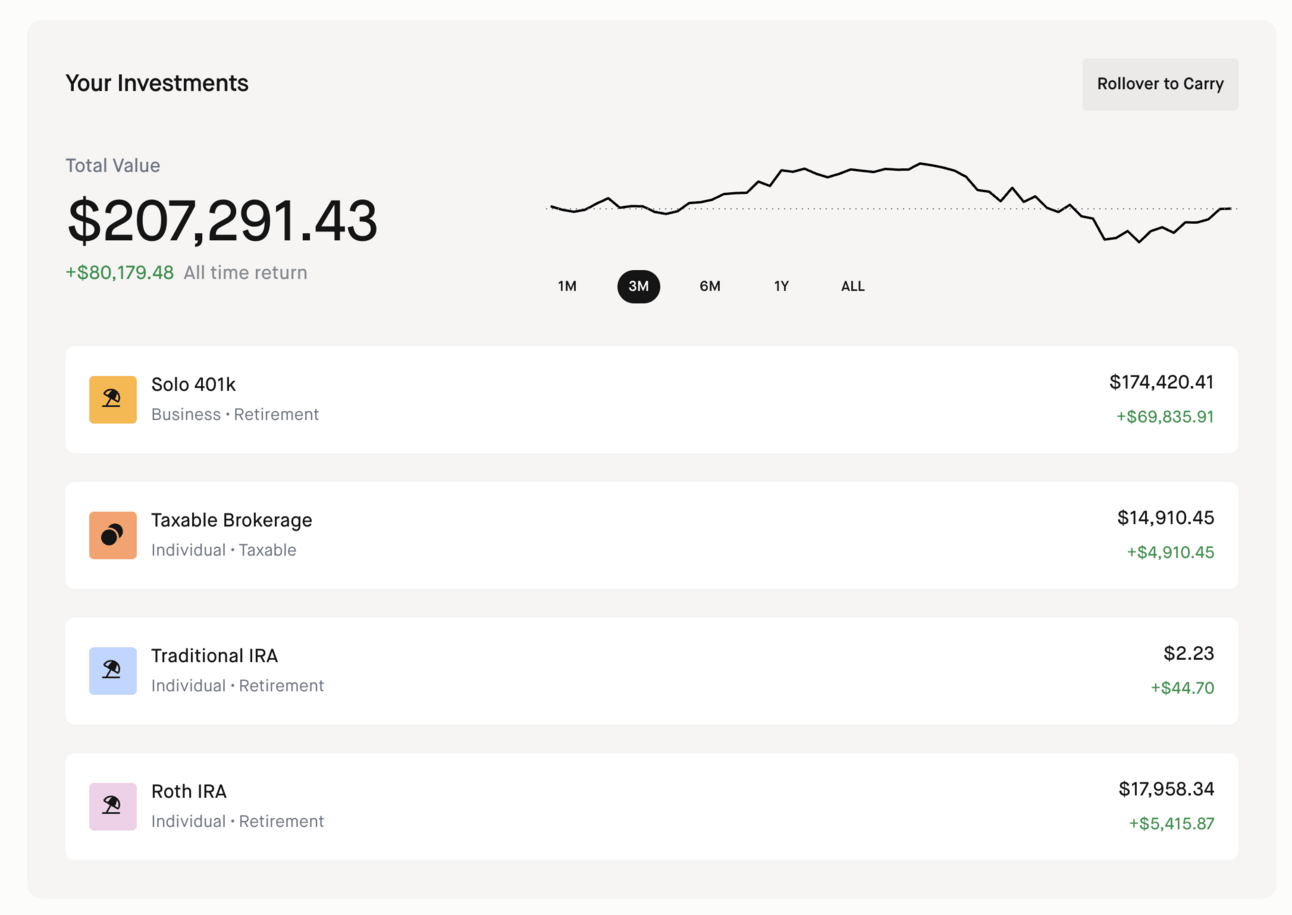

Carry

I’m biased, but if you care at all about any of the “powerful” features of a Solo 401k, most of the traditional providers will not get you that.

Things like:

Mega Backdoor Roth

Ability to invest in alternative assets

Support for taking out participant loans

Ability to do a Backdoor Roth IRA

Payroll integrations

A fully modern UI / UX

Integrated tax filing (for an extra fee)

While Carry is a paid platform, the cost of setting up a plan is more than offset by the $500 automatic contributions tax credit you would receive by using our plan document.

Other traditional providers do not offer this tax credit so their “free” plan may net out to be more expensive.

Special Silly Money reader offer: You can use this special link to get $100 off any Carry annual paid plan.

Traditional Brokerages

Most traditional brokerages now also offer a Solo 401k.

This can be the right choice for you if you are not interested in the Mega Backdoor Roth IRA, alternative investments or any of the advanced features. This could also allow you to keep everything integrated into your current brokerage provider.

These providers now support a Solo 401k:

Charles Schwab

Betterment (0.25% asset fee)

Fidelity

eTrade

Most of these providers have painful processes to start the account — but it could be worth dealing with the annoyances and legacy technology is keeping your accounts consolidated is important to you.

3,000+ words later… I’m tired.

Let me know if there are any questions you still have about a Solo 401k that are not covered in this guide. All the information shared here is for the 2025 tax year, but I’ll keep this updated moving forward.

Stay tuned for next week’s edition!

With tax season around the corner, I’ll be expanding more on strategies for business owners and W-2 professionals to pay less in taxes.